The CFTC then corrects and verifies the data for release by Friday afternoon. Reporting firms send Tuesday open interest data on Wednesday morning. The COT data, as reported by the US Commodity Futures Trading Commission (CFTC), is from Tuesday, and is released Friday by the CFTC. This widget shows the latest week's Commitment of Traders open interest. Analysis of these related ETFs and how they are trading may provide insight to this commodity. Related ETFsįind exchange traded funds (ETFs) whose sector aligns with the same commodity grouping as the symbol you are viewing. The widget shows the Last Price of the commodity you are viewing, compared to the average last price of the same commodity for the past 18 months. They help show patterns and price trends for commodities whose prices often change with the seasons.

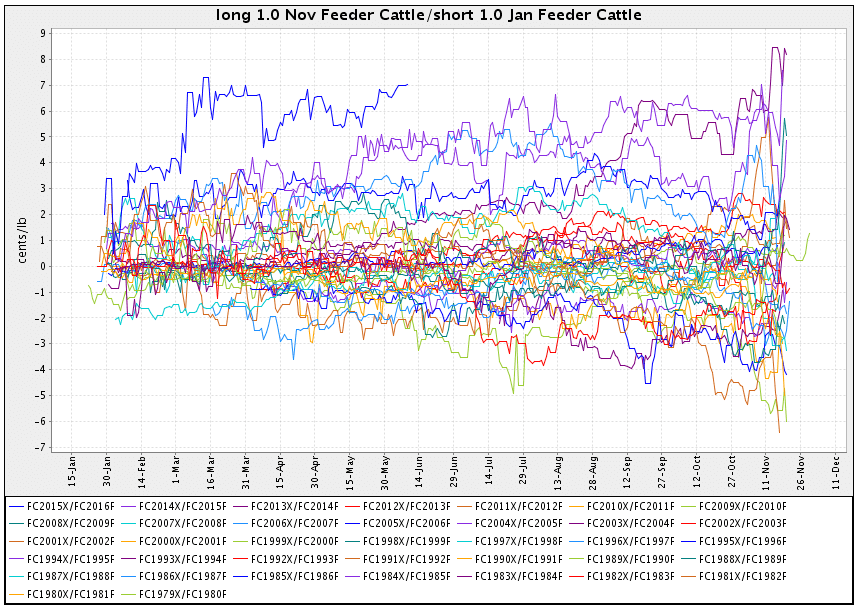

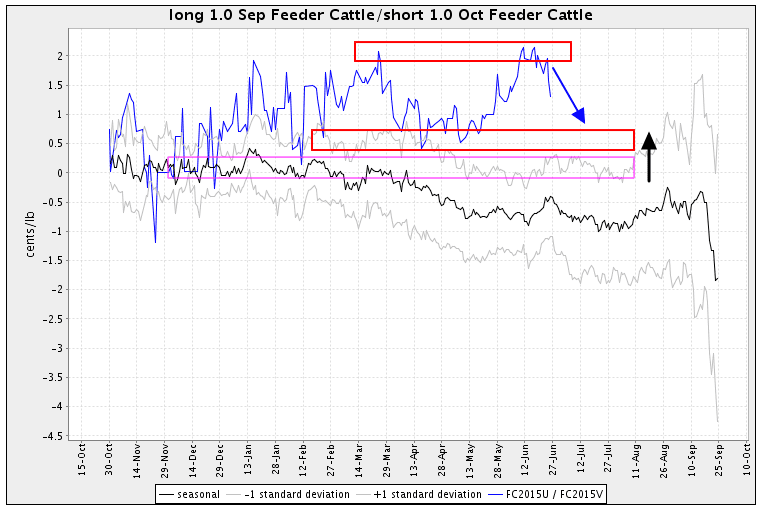

Seasonal ChartĪ seasonal chart is designed to help you visualize how futures contracts have performed during a calendar year. This section displays additional open contracts for the futures symbol you are viewing.

FEEDER CATTLE FUTURES SYMBOL FULL

Click the "See More" link to see the full Performance Report page with expanded historical information. This section shows the Highs and Lows over the past 1, 3 and 12-Month periods. Weighted Alpha: A measure of how much a stock or commodity has risen or fallen over a one-year period.Ī thumbnail of a daily chart is provided, with a link to open and customize a full-sized chart.Average Volume: The average number of shares traded over the last 20 days.Volume: The total number of shares or contracts traded in the current trading session.Previous Close: The closing price from the previous trading session.Open: The opening price for the current trading session is plotted on the day's High/Low histogram.Day High / Low: The highest and lowest trade price for the current trading session.The Quote Overview page gives you a snapshot view for a specific futures symbol. During market hours, delayed exchange price information displays (Futures: 10 minute delay, CT) and new delayed trade updates are updated on the page (as indicated by a "flash"). Federally inspected cattle slaughter was estimated at 613,000. Wholesale Boxed Beef prices dropped 22 cents in Choice and $1.83 in Select in USDA’s PM update. The group was 14,851 contracts net long on 8/1. In feeder cattle, the funds were 355 contracts more net long, as the short covering offset the long liquidation. That took the group’s net long back to below the 100k contract mark for the first time since mid-May. The CFTC confirmed long liquidation from live cattle spec traders during the week that ended 8/1. The CME Feeder Cattle Index increased by 90 cents to $245.84. Feeder cattle also rallied triple digits, going into the weekend $1.5 to $2 higher on the day and $4.50 stronger for the week’s move. USDA reported cash trading picked up on Friday with sales made mostly near $188 in the North and limited volume near $178 to $179 in the South. August was up the most ahead of Monday’s First Notice Day.

The live cattle futures market ended Friday up by $1.27 to $2.40.

0 kommentar(er)

0 kommentar(er)